This guide outlines the steps for the undergraduate student federal direct loan process. It also includes resources to help you navigate the student loan process and the CUNYfirst system.

(NOTE: Graduate students should review Graduate Student Loan guide and Doctoral (Audiology) Students should review the Doctoral Student Loan Guide)

Click here to jump to How to Apply for Federal Direct Subsidized/Unsubsidized Loan

Introduction

A Loan is money that you borrow and have to pay back with interest. Undergraduate students must file the FAFSA to determine eligibility for the Federal Direct Subsidized loan and Federal Direct Unsubsidized Student Loan.

The Parent PLUS loan is available only to parents of dependent undergraduate students and requires the parent to pass a credit check . It has a higher interest rate and loan origination fee that the subsidized or unsubsidized loan.

Who is offered a Federal Direct Loan?

A)Filed a FAFSA for the relevant aid year

B) Will have an outstanding projected balance of $500 or more after other projected aid (grants such as TAP, PELL SEOG, Vallone etc) covering direct costs is considered

C) Are in an eligible undergraduate degree program

How to request a Federal Direct Loan if one was not offered?

What if I already accepted a Federal Direct Loan and want to change the amount?

How Much Can I Borrow?

Annual Loan Limits for Direct Subsidized Loans and Direct Unsubsidized Loans

| Student Type | Dependent Undergraduate Students | Independent Undergraduate Students |

|---|---|---|

| First Year (freshman) | $5,500 (maximum $3,500 subsidized) | $9,500 (maximum $3,500 subsidized) |

| Second Year (sophomore) | $6,500 (maximum $4,500 subsidized) | $10,500 (maximum $4,500 subsidized) |

| Third Year (junior) and Beyond | $7,500 (maximum $5,500 subsidized) | $12,500 (maximum $5,500 subsidized) |

Aggregate Loan Limits: Maximum Total Outstanding Loan Debt

| Student Type | Dependent Undergraduate Students | Independent Undergraduate Students |

|---|---|---|

| Undergraduate | $31,000 (maximum $23,000 subsidized) | $57,500 (maximum $23,000 subsidized) |

Loan Proration Requirement

Federal regulations require that a direct loan be prorated when a student is enrolled in a program that is one academic year or more in length, but is in a remaining period of study that is shorter than a full academic year. As such students who graduate in the summer session or fall term will have their loans prorated based on the formula below.

Loan Proration Formula

How to Apply for or Accept a Federal Direct Subsidized/Unsubsidized Loan

Step 1 – Complete the FAFSA

Before you can be considered for a Federal Direct Loan you must first file and submit the FAFSA to determine that you meet the basic eligibility criteria for federal student financial aid programs. The FAFSA you file should reflect the academic year that you are planning to attend. For example if you are planning to enroll in the Fall 2025 and spring 2026 terms then you should file the 2025-2026 FAFSA.

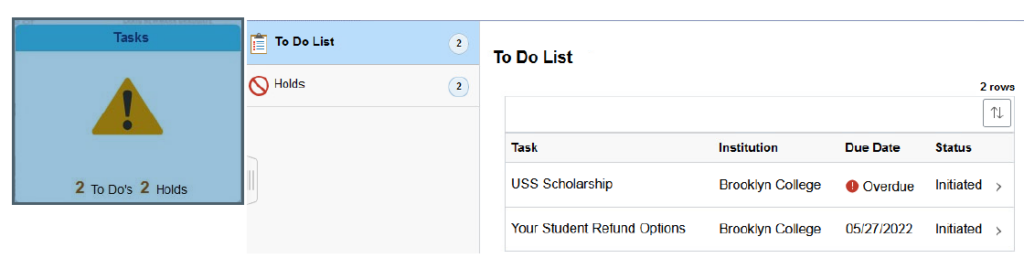

Step 2 – Review Your CUNYfirst Financial Aid “TO-DO LIST” Items

If your FAFSA requires additional documentation, CUNYfirst will alert you by listing items on the Tasks tile in your Student Center. You must complete these items before any accepted or packaged loan will be able to disburse to you. To view your “To-Do List” log onto your CUNYfirst account at https://home.cunyfirst.cuny.edu.

NOTE: As long as the to do list item continues to display to you the process is incomplete and the loan will not disburse to you.

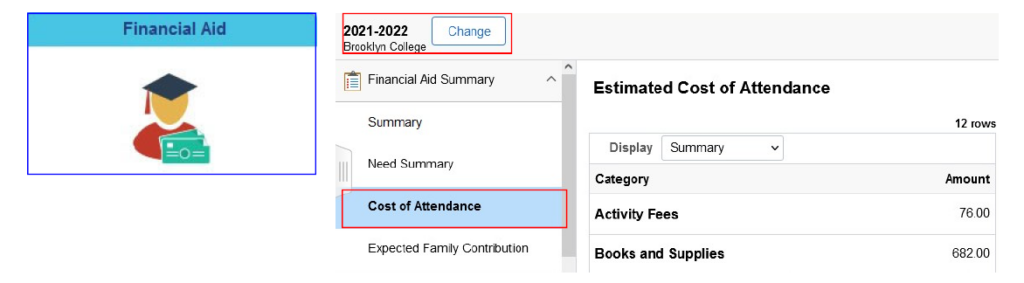

Step 3 – Review Your COST OF ATTENDANCE (Financial Aid Budget)

Your Cost of Attendance (which includes direct and indirect costs of your education) is used to determine the maximum amount of financial aid (grants, federal work-study, scholarships and loans) you may receive during an academic year. It is important to review your cost of attendance before borrowing so that you understand borrowing limitations. You cannot borrow or receive aid that is in excess of your Cost Of Attendance.

View your Cost of Attendance:

- Access the Financial Aid tile in your CUNYfirst Student Center.

- Confirm the appropriate aid year in the top left of the page (use the Change button if the current aid year is not the default). Note: the screenshot example below shows costs for the 2021-2022 year.

- Under the “Financial Aid Summary menu” on the sidebar select “Cost of Attendance”.

Step 4 – Enroll For Courses (at least 6 Credits)

You must be matriculated in an eligible undergraduate degree program and enroll for at least 6 credits of undergraduate coursework in the term(s) for which you are seeking the loan to be eligible for a loan disbursement.

Undergraduate programs ineligible for Federal Student Loans are: Non-Degree and Certificate programs not on this list.

Step 5 – Complete an Entrance Counseling Session and Sign your eMPN,

If this is your first time borrowing a Federal Direct Student Loan at Brooklyn College, you must complete the below requirements before your loan will disburse to you:

NOTE: Make sure you are signing the correct type of promissory note for the type of loan you are borrowing. Other types of promissory notes for other types of loans are available on that webpage.

Financial Aid TV- Loan Entrance and Promissory Note Video

Step 6A – Accept, Reduce, or Decline your Subsidized and/or Unsubsidized Loan on CUNYfirst

Skip to step 6B if you do not have an offered loan on your financial aid package.

The loan is offered as a fall/spring loan. This means that the loan amount will be divided evenly between the fall and spring terms. Depending on your tuition charges this may not be sufficient to cover your full balance.

You can accept, reduce, and then accept, or decline the annual loan award by following the steps outlined in the CUNYfirst Student Financial Aid Guide on or Information Guides page (refer to pages 11-12 in the guide).

NOTE: If you are seeking to borrow a semester only loan you must decline the offered loan and use the Federal Direct Loan Change Form to request a semester only loan.

Step 6B – Submit a Federal Direct Loan Request form in Dynamics Forms

NOTE: the loan will not disburse if the steps above have not been completed.

Parent Plus Loan

Parents of dependent students may borrow to assist their child in meeting educational costs by submitting a Parent PLUS loan form in Dynamic Forms. The Parent PLUS loan allows parents to borrow up to the full annual cost of attendance (COA) minus other financial aid received (scholarships, federal student loans, private loans etc.).

As the parent is the borrower of the loan the loan proceeds are only issued to the parent directly. Parent PLUS loans are not disbursed or refunded to students.

The student must be enrolled for at least 6 credits.

A Parent who applies for a PLUS loan must:

1) Meet Federal Basic Eligibility Criteria

2) Sign the Parent PLUS Master Promissory Note (MPN) at studentaid.gov

3) Complete and submit their portion of the electronic Parent Plus Loan Dynamic Form

4) Pass the credit check (if you fail the credit check you may either obtain an endorser or appeal the decision. If you fail the credit check you must also complete PLUS Credit counseling even if you obtain an endorser or appeal the decision).

Pending Aid in CUNYfirst

For detailed steps on how to view pending financial aid refer to the CUNYfirst Student Financial Aid guide.

Loan Disclosure and Disbursement

Spring 2026 – February 2nd

Additional Resources

Financial Aid TV – Loan Videos

Financial Aid TV Videos: Loan Overview

Financial Aid TV Videos: Loan Programs

Financial Aid TV Videos: Loan Repayment

Need More Help?

Review our Financial Aid Services page for more information on how to speak with a representative or schedule a financial aid planning session with a financial aid advisor.

General email inquiries may be sent to finaid@brooklyn.cuny.edu

General inquires by phone: Student Financial Services Call Center (718)-951-5051