Introduction

Federal Direct Loans and Alternative Private educational loans are available financial aid options for Doctoral (Audiology) students at Brooklyn College. Federal direct loans require an applicant to file the FAFSA to determine basic eligibility criteria. The Federal Direct Unsubsidized loan has a loan origination fee and accrues interest from the time of disbursement. The Federal Graduate PLUS loan has the above, requires passing a credit check, has a higher interest rate and loan origination fee. The loan origination fee amount and interest rates are determined annually by the U.S. Congress.

Alternative private educational loans do not require students to file the FAFSA. They may carry an origination fee and they typically accrue interest from the time of disbursement. Interest rates, fees and repayment obligations are set by the lender. As such there is no set interest rate, that may vary by lender and credit history.

Federal Direct Unsubsidized and Graduate PLUS Loan Process

Step 1 – Complete the FAFSA

Before you can be considered for a Federal Direct Loan (unsubsidized or Graduate PLUS) you must first file and submit the FAFSA to determine that you meet the basic eligibility criteria for federal student financial aid programs. The FAFSA you file should reflect the academic year that you are planning to attend. For example if you are planning to enroll in the Fall 2025 and spring 2026 terms then you should file the 2025-2026 FAFSA.

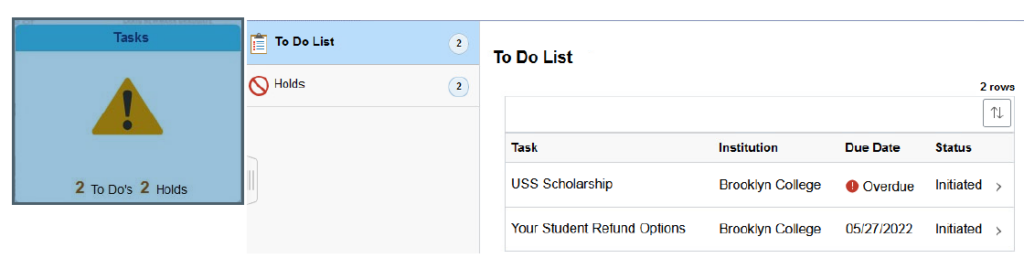

Step 2 – Review Your CUNYfirst Financial Aid “TO-DO LIST” Items

If your FAFSA requires additional documentation, CUNYfirst will alert you by listing items on the Tasks tile in your Student Center. You must complete these items before any offered or accepted loan will be able to disburse to you. To view your “To-Do List” log onto your CUNYfirst account at https://home.cunyfirst.cuny.edu

Step 3 – Review Your COST OF ATTENDANCE (Financial Aid Budget)

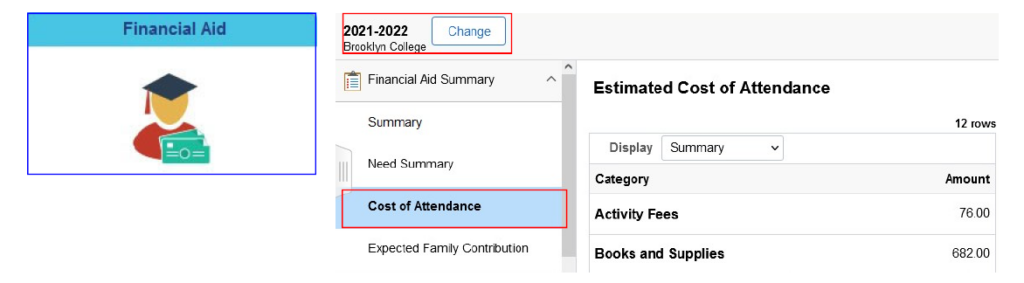

Your Cost of Attendance (which includes direct and indirect costs of your education) is used to determine the maximum amount of financial aid (scholarships and loans) you may receive during an academic year. It is important to review your cost of attendance before borrowing so that you understand borrowing limitations. You cannot borrow or receive aid that is in excess of your Cost Of Attendance.

View your Cost of Attendance:

- Access the Financial Aid tile in your CUNYfirst Student Center.

- Confirm the appropriate aid year in the top left of the page (use the Change button if the current aid year is not the default). Note: the screenshot example below shows costs for the 2021-2022 year.

- Under the “Financial Aid Summary menu” on the sidebar select “Cost of Attendance”.

Step 4 – Enroll For Courses (at least 6 Credits)

You must be matriculated in an eligible graduate degree program and enroll for at least 6 credits (or weighted credits) in the term(s) for which you are seeking the loan to be eligible for the loan.

Step 5 – Complete an Entrance Counseling Session and Sign your eMPN,

If this is your first time borrowing a Federal Direct Student Loan, you must complete the below requirements before your loan will disburse to you:

If you have already completed one in the past you only need to change the school code to Brooklyn College.

NOTE: Make sure you are signing the correct type of promissory note for the type of loan you are borrowing. The unsubsidized loan and the Graduate PLUS loan have separate and different promissory notes because the terms of the loans are different. If you are utilizing both you will need to sign two promissory notes.

Financial Aid TV- Loan Entrance and Promissory Note Video

Step 6 – Accept, Reduce, or Decline your Unsubsidized Loan on CUNYfirst

All Doctoral students who file a FAFSA will have a Federal Direct Unsubsidized Direct Loan of up to $20,500 offered on their aid package. They will also have a Graduate Plus loan offer (more on this in the Graduate PLUS loan section below).

The unsubsidized loan will not disburse if it has not been accepted or if the steps above have not been completed.

You can accept, reduce, and then accept, or decline the annual unsubsidized loan award by following the steps outlined in the CUNYfirst Student Financial Aid Guide on or Information Guides page (refer to pages 11-12 in the guide).

Loan Limits for Professional Study

| Graduate/Professional Students | Maximum Loan Amounts |

|---|---|

| Annual Unsubsidized Loan Amount | $20,500 |

| Lifetime Aggregate Borrowing Limit* | $138,500 |

*The Lifetime Aggregate Borrowing Limit includes any borrowing from undergraduate study or prior graduate degrees.

Graduate Plus Loan

Students who need to borrow more than the maximum unsubsidized loan of $20,500 (or those who have already met the lifetime limit on federal direct loan borrowing) to meet their educational costs may request an additional loan by applying for a Graduate PLUS loan.

The Graduate PLUS loan allows students to borrow up to the full annual cost of attendance (COA) minus other financial aid received (scholarships, federal student loans, private loans etc.).

A credit check will be performed by the U.S. Department of Education during the origination process to determine your credit eligibility for the Graduate PLUS loan. The PLUS loan has a higher loan fee and interest rate.

Graduate PLUS Loan Application Process

2) Sign the Graduate PLUS Master Promissory Note (MPN) at studentaid.gov (you may also need to update your entrance counseling if you previously did it only for subsidized and/or unsubsidized loans).

3) Complete and submit the electronic Graduate Plus Loan Application on the Financial Aid Office Forms Page (scroll down to the Federal Direct Loan section).

4) Pass the credit check (if you fail the credit check you may either obtain an endorser or appeal the decision. If you fail the credit check you must also complete PLUS Credit counseling even if you obtain an endorser or appeal the decision).

5) Enroll for at least 6 credits (or weighted credits) and attend classes.

Pending Aid in CUNYfirst

For detailed steps on how to view pending financial aid refer to the CUNYfirst Student Financial Aid guide.

Loan Disclosure and Disbursement

Spring 2026 – February 2nd

Additional Resources

Financial Aid TV – Loan Videos

Financial Aid TV Videos: Loan Overview

Financial Aid TV Videos: Loan Programs

Financial Aid TV Videos: Loan Repayment

Need More Help?

To ensure the best service, Audiology students should contact Assistant Director of Financial Aid Klarinda Louis (Klouis@brooklyn.cuny.edu) directly for financial aid inquiries.